Can I Transfer Money From Paypal To Cash App

From the go-to online shopping partner PayPal to the new kid on the block offering free debit cards like Square's Cash App, you are probably wondering how to connect them. Digital transactions are the future, but with several e-wallets and apps that you need to keep track of, you probably need a little help.

While most people already have PayPal and Cash App accounts, connecting them is not very intuitive but it is definitely possible. Here's how:

You can connect both PayPal and Cash App through these methods. However, there is no way to send money from PayPal to the Cash App directly. Alternatively, you can send or transfer money directly to their respective debit cards – the PayPal Cash Card and Cash App Card or transfer funds from your PayPal account to your bank account and then to the Cash App instead.

There is no one-click way to do it. However, there are two ways to send money across PayPal and Cash App – a linked bank account or their respective debit cards. Both methods will require a few extra steps to get the job done.

- Go to – PayPal to Cash app

- Go to – Cash app to PayPal

More in-depth on how you can connect your PayPal and Cash App accounts:

Two Ways to Send Money Between PayPal to Cash App

Depending on who you are transferring to, how long you are willing to wait, or what existing cards you already have access to, you can choose to do either option to send money between your two accounts.

We'll discuss both methods below:

Option 1: How to Connect PayPal and Cash App through a Linked Bank Account

While some of the benefits of using both PayPal and Cash App include not having to link your bank account, many people still opt to do so for convenience.

Despite it not being the most elegant or quickest way to do so, you can transfer your PayPal and Cash App balance through a linked bank account.

- Connect your PayPal to your bank account

- Connect your Cash App account to your bank account

- Transfer money from the origin account to the linked bank account

- Transfer money from the bank account to the target account

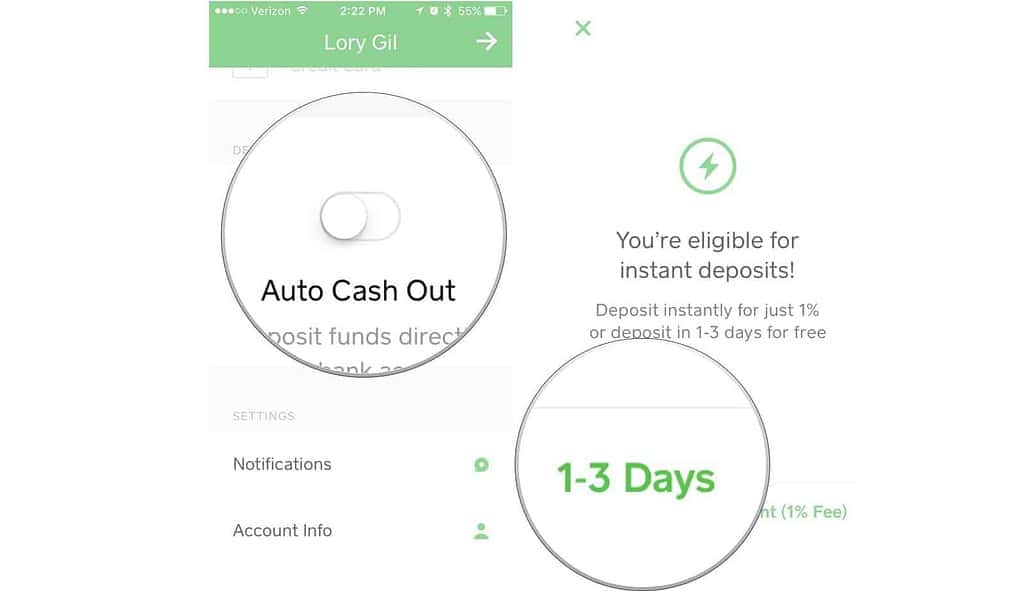

This method is best for people transferring to themselves and across their personal accounts. While transfer fees are usually free, you may have to wait 1-3 business days in between transfers or pay an additional instant transfer fee.

Here is a step by step guide on how you can connect your two Apps using a Linked Bank Account:

1. Connect Your PayPal to your Bank Account

Before we talk about the steps to transfer money between your PayPal and bank account, be sure to check the necessary fees you should expect to pay if you want to expedite your money transfer. Then, we can proceed to connect your account:

Steps to Connect To Your PayPal to your Bank Account

To connect your PayPal account App to your bank account, follow these instructions:

1. Go to the PayPal Website

2. Log in to your PayPal Account

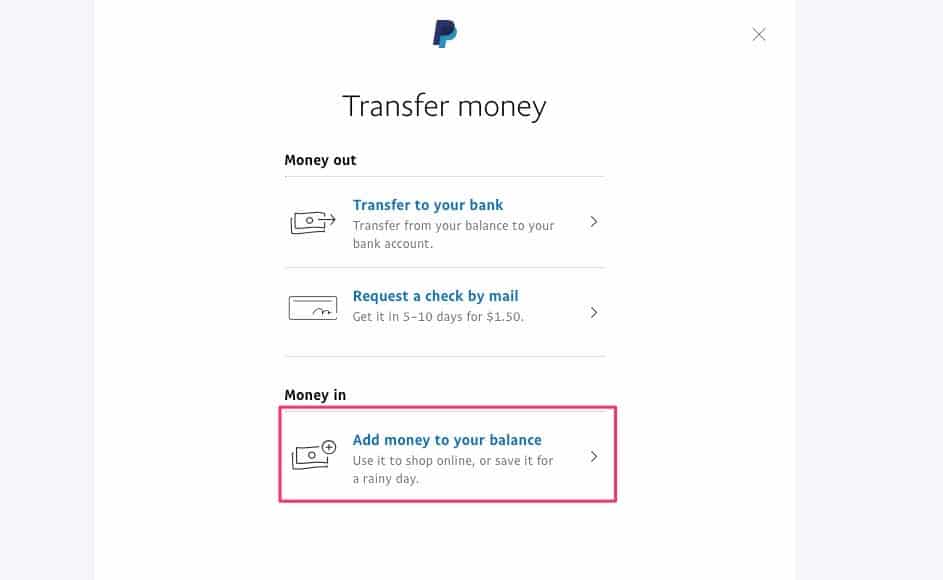

3. Click "Transfer Money" on the left side of your dashboard

4. Choose between the Instant and Standard Transfer types and press "link a bank"

5. Type in your bank routing and account numbers

6. Confirm the connection.

Now that your PayPal and your bank account are connected, you have to make sure that your Cash App account is linked to the same one as well.

2. Connect Your Cash App to your Bank Account

Connecting your Cash App account to your bank account can be done easily through the Cash App. Before you can do that, make sure you know the fees involved with transferring money from your Cash App to your bank.

Steps to Connect Your Cash App to Your Bank Account

First, to connect your Cash App account to your bank account, follow these instructions:

- Open Cash App

- Select the Banking icon on the lower bottom part of your app

- Tap "Link Bank" under Linked Accounts

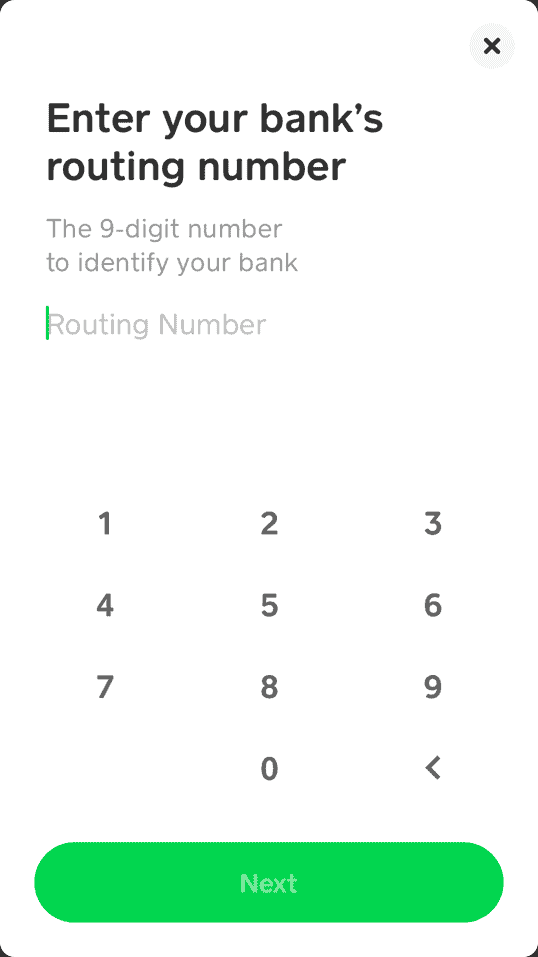

- Key in your bank account and routing numbers

- Confirm to link the account

Now that you know how to connect Cash App and PayPal to the same bank account, you can begin transferring money through it.

3. Transfer to Bank Account

From your origin application, you may transfer to your bank account. Along with this, standard transfers are free for both platforms, while Instant Transfers require a small fee.

4. Transfer from Bank Account to Target Application

Different banks will have different steps for transferring to both PayPal and Cash App. However, cashing in money from your bank account to PayPal or Cash App is usually free. Make sure that the details you add are correct to avoid any issues.

Option 2: How To Connect PayPal and Cash App through PayPal Cash Card and Cash App Card

While there is still no direct way to send money from PayPal to Cash App, you can still connect both of them through their debit card. Here is how:

- Activate your PayPal or Cash App Debit Card

- Get your PayPal Cash Card or Cash App Card bank and routing numbers

- Add your PayPal or Cash App as a bank

- Transfer your money from your origin account to your target account

- Check if the transfer was successful

This method is the best to use when transferring money to an account that is not your own. It is also the only way for people who do not feel safe linking their bank accounts for seasonal transactions.

Having the designated debit cards on hand like the PayPal Cash Card or Cash App Card will make this the fastest way to transfer money from PayPal to Cash App.

If you are still scratching your head trying to get your small business earnings into your Cash App balance, we've got you covered. Keep reading our guide below:

Steps to Connect PayPal and Cash App through their Debit Cards

Upon activation, routing and bank account numbers are assigned to the respective debit cards – the PayPal Cash Card and Cash App Card, which you can use to transfer as a bank.

In this next section, we will walk you through transferring from PayPal to Cash App, and vice versa. Let's get to it.

How To Connect PayPal with Your Cash App Card

Sending money from PayPal to Cash App requires your Cash App bank details. To get these numbers, you must first have an activated Cash App Card.

Formerly, Cash App lets users get away with not asking for a physical card. Nowadays, you need to get your physical card before you can use your virtual one. Here's how to do it:

1. Activate your Cash App Card

While Cash App Cards are free with every Cash App account, you have to activate it first. However, before you can activate your PayPal Cash Card, you must first request it.

How To Request for a Cash App Card

Requesting for a Cash App card can be done in under five minutes. Additionally, you must be at least 18 years old to apply for a Cash App Card.

- Open your Cash App

- Tap the Cash Card Icon, the second icon on the lower part of the screen

- Tap "Order"

- Choose the color of your Cash App Card

- Toggle the button to the right if you want your $Cashtag to appear on your Cash App Card

- Next, type in the address where you would like your physical card mailed to.

- Verify your identity by typing in your name, birthday, and the last four digits of your social security number (SSN)

- Check if the information you typed in is correct

After you have completed the Cash App card application process, you can expect your physical Cash App Card to arrive within ten (10) days of activation.

How To Validate Your Cash App Card

Once you receive your Cash App Card in the mail, there are two ways to validate it: QR and CVV.

Steps to activate your Cash App Card With QR Code

- Open your Cash App

- Tap the Cash Card Icon, the second icon on the lower part of the screen

- Select "Activate Cash Card"

- Scan the QR code found on your Cash App card

Steps to activate your Cash App Card With CVV

- Open your Cash App

- Tap the Cash Card Icon, the second icon on the lower part of the screen

- Select "Activate Cash Card"

- Tap "Missing QR Code" on the lower part of the screen

- Type in your CVV number located on your Cash App Card

Once you have validated your Cash App Card, you can now get access to your bank and routing numbers. To find them, read below:

2. Get your Cash App Card bank and routing numbers

Despite not being an actual app, Cash app enjoys the benefits of traditional banks due to its partnerships with Sutton Bank and Lincoln Savings bank.

To find your Cash App bank and routing numbers, you may check your app with a few clicks:

- Open your Cash App

- Tap the "My Cash" tab or the $ icon on the lower left part of the screen

- Select "Cash"

- Tap "Direct Deposit"

- Tap "Get Account Number"

- On the pop-up screen, select "Enable Account"

- Take note of your bank account and routing numbers

Now that you have your Cash App account bank details, you can proceed to add them to your PayPal account.

3. Add your Cash App as a bank on PayPal

To add Cash App as a bank, you can either use the PayPal website or through your mobile device. Here's how you can do both:

How to Add your Cash App as a bank on the PayPal Website

While the PayPal app may be useful, it's still missing a lot of functionalities that many business owners need access to. Subsequently, if you do not have your phone with you, here's how you can easily add your Cash App as a bank:

- Go to the PayPal Website

- Log in to your PayPal Account

- Click the "Settings" or gear icon on the rightmost part of your menu bar

- On the left part of the screen, click "Money, banks, and cards"

- Under Bank Accounts, click "Link A New Bank Account"

- Key in your Cash App bank details which include account type, routing number, and bank number. Click "Link Your Bank"

- Save your account details

However, if you want to link your Cash App as a bank while you are on the road, you can also do this through your mobile phone or tablet using the PayPal app.

How to Add your Cash App as a bank on PayPal through the PayPal App

The PayPal App is available on both iOS and Android. Unfortunately, linking a bank account is just one of the functionalities that currently aren't fully functional yet on the app.

However, while there is no way to add the bank completely from the app, you can begin the process in-app and finish it on your mobile phone's browser. Additionally, to add a bank through on PayPal through your mobile device follow these steps:

- Open your PayPal app

- Log in with your PayPal Account

- Tap "Settings", the gear icon on the upper right corner of the app

- Select "Bank Accounts and Credit Cards"

- Press the + icon

- Select "Bank Account"

- Tap "Go to Our Website"

The app will then lead you to a web browser log in form, where you will be able to log-into your PayPal account. Once you are logged in, you'll be able to access your PayPal dashboard.

- Expand the menu by tapping the hamburger icon on the upper left side

- Select "Settings"

- Tap "Money, banks and cards"

- Under Bank Accounts, tap "Link a new bank account"

- Key in your bank details, which include account type, routing number, and bank number. Click "Continue"

- Save your account details

Now that you have your Cash App account linked to your PayPal, you can transfer your PayPal balance to Cash App.

4. Transfer your money from PayPal to Cash App

When transferring money from PayPal to Cash App, you can choose to send money from your PayPal-linked credit card or available balance. To do this, you have the option to use the PayPal website on your browser or through the mobile phone app.

How to Transfer your Money from PayPal to Cash App Through the PayPal Website

PayPal's website lets you transfer money from your PayPal-linked credit card or PayPal balance to Cash App. To do this, just follow the steps below:

- Go to the PayPal Website

- Log in to your PayPal Account

- Click "Transfer Money" on the left side of your dashboard

- Choose between the Instant and Standard Transfer types

- Type in your Cash App bank routing and account numbers

- Confirm the transaction.

Otherwise, if you prefer to do this through a mobile device, you can check how below:

How to Transfer your Money from PayPal to Cash App Through the PayPal App

Thankfully, transferring money with the PayPal mobile App is possible in just a few clicks. Here how you can do it:

- Open your PayPal App

- Log in with your PayPal Account

- Tap your PayPal balance

- Tap "Withdraw Funds"

- Select your Cash App bank details

- Tap "Next"

- Key in the amount you wish to transfer

- Press "Continue"

- Review your transfer

- Tap "Transfer X Amount Now"

- Select "Done"

Furthermore, be sure to check if your transaction is successful by going to your Cash App, and reviewing the balance within the expected transfer dates.

How To Connect Cash App Account with your PayPal Cash Card

To be able to transact a direct deposit to your PayPal account from Cash App, you need to enable your PayPal Cash Card.

Different from the PayPal Credit Card, the PayPal Cash Card lets you access funds directly from your PayPal balance. It allows for direct deposit at no costs, no monthly fees, and no minimum balance.

The PayPal Cash Card lets you shop anywhere that a MasterCard is accepted. By transferring your Cash App balance to PayPal Cash Card, you can free access to over 33 thousand ATMs, and Tap & Pay through checkout. Additionally, you can feel safe with the MasterCard Zero Liability Policy.

1. Activate your PayPal Cash Card

Before you can activate your PayPal Cash Card, you have to first request for it. Subsequently, here is how you can make a request and activate your PayPal Cash card through the PayPal App:

How to Request for a PayPal Cash Card Through The PayPal Website

- Go to the PayPal Cash Card Page

- Click "Get the Card"

- Log into your PayPal Account

- Tap "More" or the three dots icon on the lower right corner of your app

- Tap "Order a PayPal Cash Card" or "Order a Cash Card"

- If you haven't upgraded to a PayPal Cash Account, PayPal will ask you to upgrade before you can proceed.

- Confirm your address for delivery.

After you have requested a PayPal Cash Card, you can expect to receive it within 7-10 days. Once you have received your money, you can proceed to activate it.

How to Activate Your PayPal Cash Card

- Go to the PayPal Cash Card Activation Page

- Log into your PayPal Account

- Key in your card's expiration date

- Click "Activate Card"

- Type your 4-digit PIN

- Click "Create Pin"

- Confirm your card activation.

Now that your PayPal Cash Card is on the way to you, you must now find your bank account and routing numbers.

2. Get your PayPal Cash Card bank account and routing numbers

To find your PayPal Cash Card direct deposit details, follow these steps:

- Go to the PayPal Website

- Log in to your PayPal Account

- Click the "Settings" or gear icon on the rightmost part of your menu bar

- Select "Set up or view direct deposit"

- Take note of your banking account and routing numbers

With your PayPal Cash Card bank details in mind, you can proceed to add it as a bank on your Cash App.

3. Add your PayPal Cash Card as a bank on Cash App

To add your PayPal Cash Card as a bank on Cash App, all you have to do is the following:

- Open Cash App

- Select the baking icon on the lower bottom part of your app

- Tap "Add a Bank" under Linked Accounts

- Key in the PayPal Cash Card account and routing numbers

- Confirm to link the account.

Next, you are ready to transfer money directly to your PayPal Cash Card from Cash App.

4. Transfer your Money from Cash App to PayPal

Depositing money to your PayPal Cash App Card from Cash App will be like any other deposit to another bank. To do so, follow these steps"

- Open Cash App

- Select the Balance tab or the $ icon on the bottom of the screen

- Press "Cash Out"

- Key in the amount you want to send to PayPal and press "Cash Out"

- Select deposit type (Instant or Standard)

- Confirm deposit with your Cash App PIN or Touch ID

However, if you did not opt for the instant transfer speed, you should expect to receive your money within 1-3 business days.

5. Check if the Transfer was successful

Finally, be sure to check if the transfer was successful. As Cash App is not FDIC-insured, it is best to check if the PayPal Cash App number is correct. Furthermore, recovering money sent to the wrong account will be impossible.

Transfer Cash App To PayPal

However, at the time of writing, Cash App and Paypal don't work together. That doesn't mean that it's impossible to send money from Cash App to Paypal, but it is a bit more complicated than sending it from Cash App to Venmo, for example. In this guide, we're going to cover exactly how you can send money between these banks as easily as possible.

Cash App doesn't allow you to transfer to Paypal at this time. However, if you need to move money from your Cash App account into your Paypal one, you can do so by moving the money through your bank account.

As we've explained above, there's no way to transfer your money directly between these two online banks. Instead, you need to use a third bank account as a bridge between the two. This third account should be a major bank, one that's likely to have brick and mortar locations on the high street.

When you've chosen the bank that you want to use, then follow these steps, and you'll be able to transfer money as you wish.

1. Add the Bank Account to Cash App

- Tap the '$' icon

- Tap 'Add Bank Account'

- Type in your bank account's card details

To do this, you'll need to open Cash App and tap the '$' icon in the bottom-left of the screen. This will take you to a new screen that displays your balance. Here you need to press the 'Add Bank Account' button.

At this point, you will be asked for the card details for the card associated with the bank account you've chosen to use for this process. You'll need the following details of that card.

- The long card number across the front of the card

- The expiry date

- The last three digits on the back of the card

With all of this information, you'll be able to add the card, and therefore the bank, to your Cash App account.

2. Cash Out to the Bank Account

- Press the '$' sign

- Tap the 'Cash Out' button

- Type in the amount to send and press 'Cash Out'

- Select the bank account to send the money to

- Choose whether to send the money instantly or via standard transfer

Now you need to navigate back to your balance screen and press the '$' sign again. Instead of adding another account, you next need to press the 'Cash Out' button. This will open a popup that requires you to type in the amount of cash you want to send.

Type in the amount you want to send, and tap 'Cash Out' again. Now you will select the bank account that you want to send money to. Select the bank you just added.

At this point, you have two options. You can send the money via standard transfer, which can take up to one week to go through or opt for an instant transfer. An instant transfer will happen the same moment you send the money, but it will cost you $10 or 1% of the amount sent, whichever is cheapest. Please note that the minimum is $0.25 though.

3. Add the Bank Account to Paypal

- Select the 'My Money' option under the 'Account' menu

- Select 'Update' from the 'Bank Account' section

- Add your bank account

- Confirm the bank account

Now that you've sent the money, it's time to add the bank account to your Paypal account. This is just as easy as it is with Cash App.

Log into your Paypal account, and under the 'Account' menu, select the option to 'My Money.' In the 'Bank Account' section, you now need to press 'Update.'

Now you can enter the details of your bank account. You will need the following.

- Bank name

- Name and address associated with the account

- Sort code/routing number

- Bank account number

At this point, there are two options. If you choose to 'Confirm Instantly,' then you can use mobile banking with this bank account to confirm the bank account. If not, then you'll have to wait for 2-3 business days before the account is confirmed.

4. Transfer the Money From Your Bank to Paypal

- Under the 'My Account' menu select 'Add Money'

- Select the bank account

- Define the amount you are transferring

- Confirm the transfer

Once the money from Cash App is in your bank account, it's time to transfer it to Paypal. Choose the 'Add Money' option under the 'My Account' menu. Now you need to choose the bank account that you transferred money to from Cash App. You can have multiple bank accounts linked to Paypal, but we need the one with the funds from Cash App for this example.

Now you need to choose the amount that you want to withdraw from your bank account. It should be the same as the amount that you sent from Cash App. Then submit and confirm the process.

This transfer will take up to 5 business days. Keep checking your Paypal account to see when the money comes through.

Conclusion

That's how you transfer money from Cash App to Paypal. We know that it's an incredibly complicated process, but it's the only way you can do it right now. Until Cash App opens up their bank accounts to allow Paypal, you can't send money directly from one to the other.

Frequently Asked Questions

Why are my transfers not working?

Both PayPal and Cash App have systems in place to prevent fraudulent transactions. If you do not regularly use PayPal, they may hold your balance until you have made sufficient transaction requirements. You may contact their support for help.

How much are the transfer fees between PayPal and Cash App?

Both PayPal and Cash App have free standard transfers. For instant transfers that appear within minutes, you can expect to pay %1 of the amount you are transferring, up to $10 for PayPal, and 1.5% of the amount for Cash App.

How fast are the transfers between PayPal and Cash App?

For PayPal's instant transfer, they can take between 1-4 business days, while Cash App instant transfers arrive within 1-3 business days.

How much can I transfer between PayPal and Cash App?

From PayPal to Cash App Card, unverified accounts can send up to $500 a month. A verified PayPal account has no limits on the total amount you can send from your account. However, PayPal caps each transaction amount at $10,000.

While for Cash App to PayPal Cash Card, you can transfer up to $250 per 7 days and $1000 every 30 days when using a Basic Cash App account. After verification, you can send up to $7,500 per week and receive an unlimited amount.

Can I Transfer Money From Paypal To Cash App

Source: https://almvest.com/blog/how-to-connect-paypal-to-cash-app/

Posted by: koehlertallean.blogspot.com

0 Response to "Can I Transfer Money From Paypal To Cash App"

Post a Comment